Back in July I looked at how revenue-based mileage-earning means that passengers earn fewer miles.

The Simple Reason Revenue-Based Mileage Earning Means Fewer Miles Earned

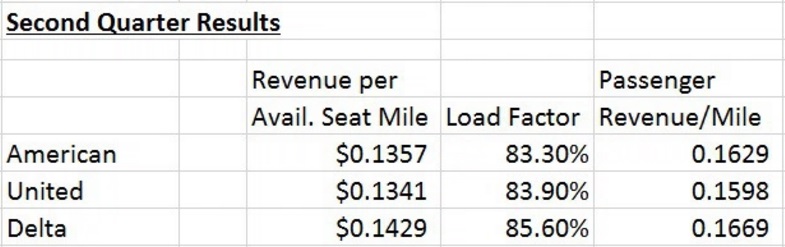

I looked at second quarter revenue per available seat mile, divided by load factor, and came up with an average fare per mile flown for Delta, United, and American. It was meant as a rough back of the envelope to compare to the ~ 20 cents a mile flown you’d have to pay to break even in your mileage earning with the way things work now.

In the simplest version, just know that the basic earning in a revenue-based frequent flyer program has required 20 cents a mile to break even with a mileage-based earning system. And passengers aren’t paying the airlines an average of 20 cents a mile to fly.

Of course, when airlines have switched to revenue-based mileage earning it’s been worse than this — fewer miles award on average, but they’ve also taken the opportunity to diminish the value of the miles you do earn. And that puts the lie to the idea that they’re “rewarding high value customers.” They’re not, they’re only devaluing high value customers less.

How Would American’s Revenue-Based Mileage Earning Work?

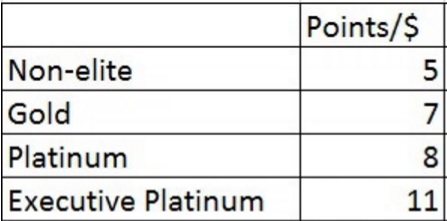

Now let’s take a look at what American seems to be moving to a year from now. Here’s the expected points-earning:

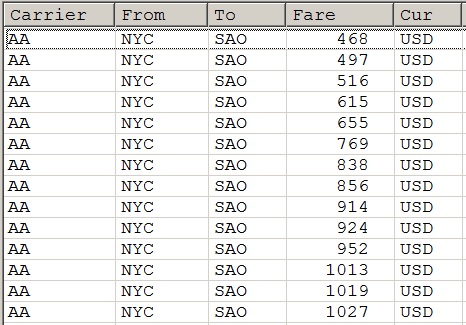

Let’s look at what that means in practice. Here’s a list of the 14 lowest fares between New York and Sao Paulo, Brazil published by American Airlines.

This is a good route to look at fares for, since while revenue-based points earning will be based on fare plus surcharges there aren’t any fuel surcharges on Brazil flights.

And let’s assume a roundtrip fare of $950. This isn’t a super expensive roundtrip, but it’s not the cheapest published fare either by a long shot.

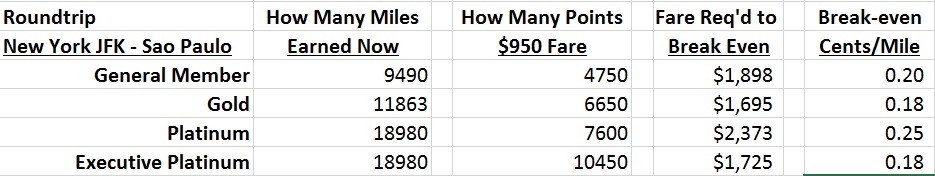

- General members see their earning cut in half.

- Golds lose 5000 miles, Platinums lose 11,000 miles.

- Executive Platinums ‘only’ lose 8500 miles.

What we see is that to ‘break even’ with current mileage earning, general members need to spend 20 cents a mile. That’s now standard across the major US airlines.

Golds and Executive Platinums, because of their mileage bonuses which are actually going up (Golds from 25% to 40% and Executive Platinums from 100% to 120%) ‘only’ have to spend 18 cents a mile flown to break even.

While Platinums have to spend 25 cents per mile to break even since American appears to be taking the opportunity to devalue Platinum benefits (mileage bonus dropping from 100% to 60%) at the same time they shift to revenue-based accrual.

It takes a roundtrip fare between New York and Sao Paulo of $1700 – $2400 to earn as many miles as AAdvantage members do now.

Results Vary With Long vs. Short Routes

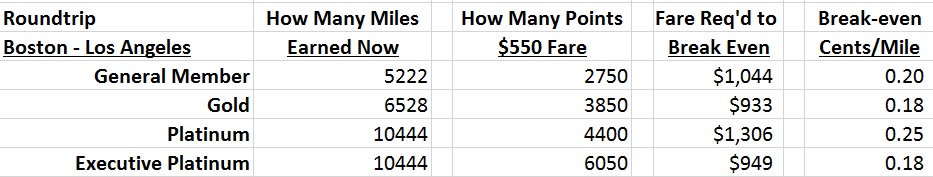

Now let’s take a look at a longer domestic route, Boston – Los Angeles.

You’ll see that a fairly standard $550 fare is a real loser. It takes fares of $930 – $1300 to break even. I’ve been forced to pay $900 roundtrips for sure, but I don’t do it all the time. And that’s just to come out even.

The 18 to 25 cent per mile break-evens remain the same here. The only time that isn’t true is with flights under 500 miles, since elites now earn 500 mile minimums but those go away under revenue-based accrual.

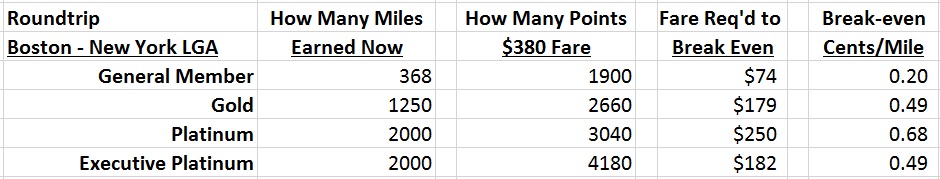

So let’s see what happens to Boston – New York LaGuardia.

Members come out ahead on short flights. And it doesn’t take an expensive ticket at all to break even. Short expensive flights are where members win. Long, relatively cheap flights are where they lose.

Paid Business Class Travel: Not As Rewarded As You’d Think?

Customers who fly longer flights will tend to do worse than customers who fly shorter ones. That’s because on average they pay fewer cents per mile flown. Of course paid business class will mean more miles as well.

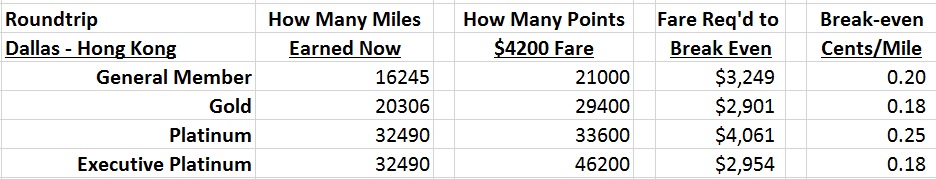

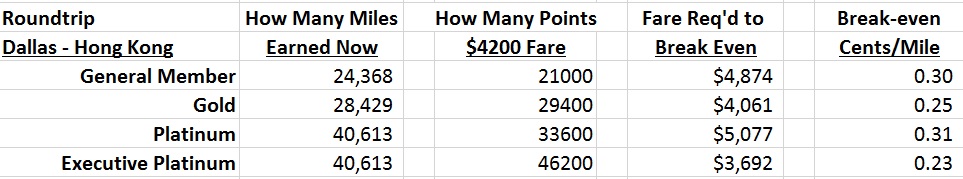

Let’s look at American’s Dallas – Hong Kong route, and assume you buy a $4200 business class roundtrip ticket.

Everyone comes out ahead, but probably by less than you’d think (and in fact, Platinums – members flying 50,000 to 99,999 miles with the airline per year – pretty much just break even).

Update: when I first posted this a few hours ago, I left out the 50% ‘class of service bonus’ from the calculation. So I had to update the chart. It’s worse than it even seemed at first:

It turns out that with revenue-based earn, it’s really the expensive business class fares on shorter flights that come out well. Think New York JFK – London. But that’s a route that frequently sees big mileage bonuses now!

Even If You Earn More Miles, You Probably Still Come Out Behind

You’ll want to understand your own flying patterns. But bear in mind that even if you can think of trips where you’d come out ahead, you actually need to average more than 20 cents a mile spent (18 cents for Golds and Executive Platinums) in order to earn more miles under American’s projected revenue-based earning structure.

And even if you’ll earn more miles a year from now, unless you’re going to earn massively more miles you’re still going to lose. Because AAdvantage miles aren’t going to become worth more. It’s much more likely that they will become worth less. We haven’t seen much change in the AAdvantage saver award chart in years. That’s likely to change.

What’s more, revenue-based points-earning has a built-in need to devalue as long as the program retains award charts. That’s because inflation alone will cause miles earning to eventually exceed what were earned before. In a few years, after we’ve seen 25% cumulative inflation, programs will be earning more miles. They’ll either need to reduce points earned, or increase the cost of awards.

Once you go revenue-based for earn, revenue-based redemptions become the logical conclusion. Because then as you spend more, earn more points, airfares are more expensive and so redemptions are more expensive too.

That’s the theory, anyway. In practice revenue-based redemptions don’t preclude devaluations, as Southwest has shown on multiple occasions, because they can — just as banana republics find it too tempting to devalue, so do airlines.

Many years ago, long before I heard of MS, I accumulated over 3 million AA miles within about 5 years and was awarded Platinum for life. It was great – until they came up with Executive Platinum and devalued most of the Platinum benefits. This now is just another added insult, though it won’t affect me much.

So, what you did in the past is meaningless. So much for “loyalty” programs.

1) Don’t you think it’s likely that they’ll put a cap on the amount of miles a given segment, oneway, ticket or something will earn? They probably don’t actually want to award 100,000 miles for buying an EZE-DFW-HKG F ticket

2) How do they handle corporate discounts – do you earn mileage based on the pre-discounted rate? Otherwise what’s the point of buying that $2400 D fare on AA when I could buy a non-preferred $4500 fare, say on another oneworld carrier, and be better off as a result?

Gary, because the Brazilian real has devalued a lot, American carriers, in general, dropped their prices on flights originating in Brazil. You can easily purchase a US$ 350-400 dollar ticket, which would earn ExP flying in Y 4400 miles, instead of the more or less 20200 we earn today on the GRU-DFW route. Add that to the probable increase in redeemable miles and I’ll take my business elsewhere.

Obs: My calculations are based on a round-trip ticket.

Given that perhaps 90% of the Aadvantage miles I have spent have come from ancillary sources, I do not anticipate the change to revenue based miles awards to impact me much at all.

If, indeed, the result is fewer miles being awarded, I might even anticipate that in an environment with fewer miles being issued, my miles from ancillary sources might become more valuable.

Gary, for your HKG example you forgot the “long distance bonus” miles for premium fares AA was giving this year. Since that was a reaction to RBS by DL/UA, it’s only fair to include that in your calculation as well.

Those DFW-HKG-DFW segments would earn an extra 3K-12K miles/segment if I recall correctly.

@gary

Gary, I have been PLA for the last 10 years, with he odd EXP year

Based in YVR and fly to GRU and EZE about 5 times a year, one Europe trip a year, and avrg 80k a year, will not stay with AA program after the changes but likely to fly on AA due to schedule, connections and fares

which ONE WORLD program would you recommend?

Looking at LAN (could also FLY with them as they code share with AS down to LAX) and also looking at AS program. as even if not full OW member, accrues nicely on BA and AA and LAN and could even use aeromexico to go down to sao and eze as they start now YVR service

never looked at Qantas or JAL program, should I?

appreciate your thoughts

tks

I welcome these changes. Not much will change for me and I’m tired of seeing 15 people on the upgrade lists. I usually clear as EXP but often times a CK will trump me.

@LR

clearly you don’t understand the changes and just want to bark

if you are EXP then why do you care how many people are UNDER you in the list?

you buy economy tickets, (since you say you always upgrade by being EXP), so you do not care about the fact that you will loose a ton of redeemable miles?

thinking that you are special does not make you one in reality, but kudos to you, great escape from reality

@LR Concierge Key doesn’t trump Exec Plat on the upgrade list.

@doug – not sure there’s a better oneworld program though I do like JAL (albeit fuel surcharges on redemptions). I think we have to wait and see what American Airlines accrual looks like in other programs AFTER the changes go into effect.

@UA-NYC I didn’t include because that was ‘temporary’ and I was trying to compare a miles system to a revenue one, and that was American’s response to revenue earn while they didn’t have such a system themselves. Didn’t seem fair to stack the deck that way.

@gary even still you forgot to add the 25% Business Class bonus which brings it to about 36,500 miles

@LR – If you were seeing 15 people on the upgrade list before, you’ll be seeing 20+ now, including more EXP’s who may be in front of you on the list. Qualification will be easier and with lower premium fares there are going to be fewer seats available for upgrade. I am sure you will welcome that.

As with UA, most of the high value business travelers will come out ahead, as was the intention. Also, as you noted when UA and DL devalued, the credit card churners will also come out ahead as they will now be earning more miles than the low fare crowd. For LAX-LHR-LHR, EXPs flying in C will now earn 11x$5k=55k instead of 25k miles. Similarly SFO-DFW-SFO on a typical $700 Y fare will earn 7700 instead of 5856. And those who were previously getting shafted on high fare, short distance routes will be more fairly compensated for their spend.

Sorry but airlines do not value the guy buying $300 transcons or $49 SFO-LAX tickets anymore. I know that you and I enjoyed elite status doing those types of trips, but those days are long gone. Which brings us to another big plus – fewer elites clogging up the elite lines and upgrade lists (assuming all those low fare elites follow your advice and abandon AA).

So not only did they screw the US Airways Platinum flyers by scrapping that tier altogether, the little crumb that was tossed their way, i.e. remaining a Platinum in name only…is going to be clawed back now. And what were the 3rd quarter profits… something around $1.7Billion? Yep. They need this revenue. One big happy family now. Oh, and if you happen to be a leisure traveler… well TS to you.

I’ve been a Plat for about 5 years now and am very disappointed to see Plat taking the brunt of the devaluation. If I am continuing to fly about 50-60K miles per year, who do you recommend that I switch to? DL? UA? Other?

I am already seeing at least one colleague seek out more expensive fares in order to get more miles under revenue-based. It’s like the Mileage Booster strategy on steroids.

They are really sticking it to the Platinum members. They are creating a huge dis-incentive to remaining loyal to AA and oneworld. Biting the hand that feeds you has never been a good strategy. what is the benefit of making a huge chunk of loyal customers mad?

Thanks Gary. I have to admit, I don’t understand all of this and I think I’m a middle of the road collector. FWIW, I think the challenge for the blogger community is to figure out a way to explain it to people like me and those that are below me in experience. I think you’re in the top 3 for bloggers, which is why I post my comment here. I’m avid, but not rabid. I’m a 15 year top tier w/ US, SPG, etc., but the whole Sao Paolo blah blah blah really means nothing to me. I’m looking for some general guidance on what to expect for domestic travel and the every now and then international travel. I suspect most of your readers are like me…cents per whatever is largely Greek. Not being critical…just offering my thoughts. The above seems like it SHOULD be meaningful to me but it means about nothing.