Barclays has been providing free credit scores to cardmembers for a couple of years.

The credit score I showed you over the weekend in my post about credit scores as a predictor of relationships was from my Barclaycard American AAdvantage Aviator Red account.

Citibank started offering scores back in January.

Chase offers them on the Slate card product but not to most Chase cardholders.

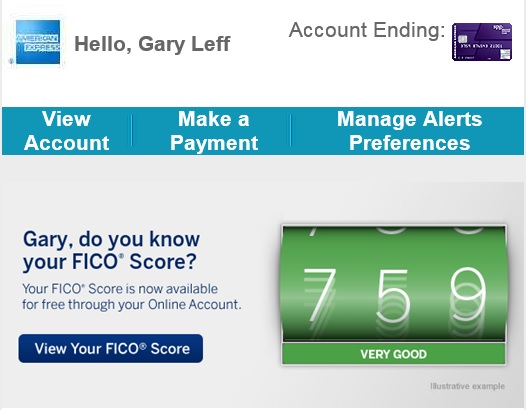

I received an email from American Express with what was news to me, that they’re now offering credit scores as well. It was sent off of my Starwood consumer card.

I pulled my score from them as well, and it’s a week older than the one provided by Barclays.

They do warn that they won’t promise to offer this forever, which I assume is the kind of cya language that’s necessary in a world where the CFPB could take an enforcement action for removing anything deemed to be a card benefit.

Only the Basic Card Member’s FICO® Score is available through this program. American Express offers FICO® Score access at its own discretion. FICO® Score access is not a permanent feature of your account and may be removed at any time. Additional terms apply.

Nonetheless it’s good to have this available from multiple sources.

They’ve done this for a long time. As does Citi.

Do we know which Fico score is used for these cards? There is more than one.

Gary, assuming 843 is your actual score, what is your strategy for maintaining a nearly perfect credit score? Despite always paying my bills on time and maintaining a nearly zero balance on my cards, I haven’t been able to raise my score above 800…

This is months old.

Yes, eg @Daniel “as does Citi” that’s even something I noted in the post. That you can get these scores from Barclays, Amex, and Citi… but not from Chase with most of their products.

@Alex part of it may just be that i’m getting old, and so do have some longer credit histories, so despite lots of account openings my average age isn’t as bad as it once was. My credit score hovered just below 800 for a long time.

Hi Gary. My Amex Everyday Preferred card got suspended few days ago. I called the card center, the manager told me she suspended the card because amex wants some info from me, then she asked me all the personal info including why I purchased an item from ebay for 780 dollars. I think that’s too personal, and she asked me what to do with the item. That’s way too far from gathering info in my opinion. She said I need to fax her the past 2 months of my debit card statements to review, otherwise she will close my card. I think this is absurd! I paid my monthly payments full all the time! She said because I’m a college student the money my parents give me shouldn’t count as reliable income. The whole thing is out of my mind and I’m really mad. Is this normal for amex to review customers like this?

@Alex I broke 900 finally this year. Active mortgage went over 10 years of history. Oldest card is 15 years. 0 dings for at least 16 years.

@Michael – everything you ever wanted to know on the topic:

http://viewfromthewing.com/2013/05/02/preparing-for-the-dreaded-american-express-financial-review/

Apparently 900+ was not a FICO score. It was on a 950 scale so not sure what Credit Union or scoring scale that was when I looked earlier this year. Sorry for the noise.

Not sure who’s FICO score I get from Amex, but it was 250 points below my accurate one from Barclays.

Obviously Gary has not been opening credit card accounts recently. The only explanation for such high score. Unless Gary charged and paid off hundreds of thousands on his credit card, nothing he could have done would make him stand out so much.

@credit

lots of assumptions on your part on what Gary does or does not do to have a high score. My credit score is 846, have opened 5 cards this year, have 9 personal cards, 5 business cards, no manufactured spend, no carried balance, always pay in full on time. total spend over all cards is no more than 25k a year. I have no car loan, even the mortgage is paid off, which can work against you.

Norita, again nothing you posted stands out. I am surrounded by people who do exactly what you do. And they make good money. I don’t know their credit scores. I know only mine and it’s not that high and yet NOTHING you do/posted makes you stand apart. I don’t mean that flippantly. Maybe there is some other bs going on in the calculation of credit scores. Some secret sauce. I had once filed a bbb complaint against experian. Maybe they are still pissed at me 🙂

these scores are a joke had over 800 went for a pre approval for a house score was like 750

I show the following free FICO scores

AMEX – Experian FICO

Barclay – Transunion FICO

CITI – Equifax FICO (using ‘enhanced’ FICO scoring 250 to 900)

Chase (Slate only) – Experian FICO

Capital One – Transunion FAKO

Discover – Transunion FICO

Does anyone show other banks providing FICO scores?

@credit I have definitely charged and paid off hundreds of thousands on credit cards. 😉

What Michael said above… I was going to ask a question about this phenomenon, myself. Earlier this year I applied for a refi on my mortgage, and even though my Experian score was showing online as 804, when I got the official refi letter from Citi, it showed that they checked my Experian score and it was only 737. I was floored because nothing had changed recently, I hadn’t applied for any new cards, had no red marks on my record, etc. Why do I get the feeling that even though Amex, Barclays, etc. offer “FICO” scores, they’re really more like FAKO scores?

Neither Amex (Platinum) nor Citi had offered me this. Does one has to ask?s it supposed to be on ones statement?

FICO has several different scoring models. Amex uses FICO 08. The credit pulls for your mortgage were more than likely the FICO Mortage scoring model. Each model uses different algorithms that give different weights to each scoring factor. That would explain the differences between FICO scores.

I would like to see my fisco cores

I would like to see my FICO score.