I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Buy Hilton HHonors Points 100% Bonus

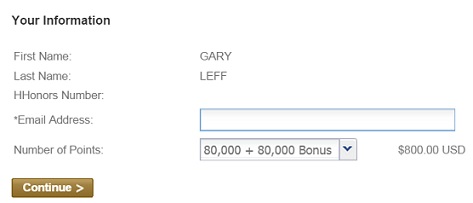

Through June 17 Hilton is offering a 100% bonus on purchased points.

When I go to the landing page I first see an offer that expired in December for a ‘mystery bonus’ but once I click through and log in the current 100% bonus offer appears.

Hilton usually charges a penny apiece for points, so with this bonus is selling points for half a cent each. That’s the cheapest I’ve ever seen Hilton sell points. And it’s the only time I’ve seen Hilton sell points for about what they’re worth.

I value Hilton points at $0.004, since I can pretty much always get half a cent in value at least from Hilton points and I have a preference for holding cash.

You can really stretch Hilton points for their lower-tier redemptions. A category 1 property is 5000 points, with 5th night free for elites, so a 5 night stay averages 4000 points per night or $20.

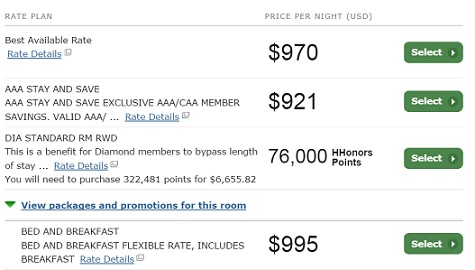

Even at top tier properties you can do well. Consider a high season 5 night stay at the Conrad Koh Samui:

You can get a $900 per night ocean villa with private pool for $380 per night worth of points.

You won’t get bonus points for paying for purchased Hilton HHonors points with a Hilton co-brand credit card, as the purchase is processed by points.com rather than Hilton.

But combining Gold status, two free nights, and up to 160,000 purchased points could be a quick shot in the arm to a status-enhanced vacation on the cheap.

I’m close to a buyer of Hilton points at half a cent apiece, and considering that I have Diamond status through February I really should consider taking advantage of this.

(HT: One Mile at a Time)

I’m with you Gary on valuing them at more like .4 cpm. Hell I might go down to .33 depending on my mood. So I won’t be buying here, especially (and this is a big especially) because they’re so damn easy to rack up.

I just don’t trust hilton. I forsee them doing a stealth deval…

Properties in Paris run 80k points per night, so $400 under this promo. Booking them outright (in August high season) would be 300 Euros + accumulation of additional points.

In SF, rates are 50k points or $300, so perhaps marginal benefit.

As Gary pointed out, the value here would be redemption at low category hotels (which I don’t normally cross paths with).

Could be a good value with AXON/GLON if you have a specific usage that you plan on booking immediately – but I wouldn’t speculate at this price.

@Gary sez: “I value Hilton points at $0.004, since I can pretty much always get half a cent in value at least from Hilton points and I have a preference for holding cash.”

Time to recycle the following and do some math to provide perspective and context to the above 😉

The statement about how much Hilton points are worth needs to be understood properly because with, e.g., SPG points being valued at 2.2 cents each, it implies that starpoints are worth 2.2/0.4 = 5.5 times HHonors points, which is ridiculous, of course, because that comparison does not account for the fact that one earns about 6 times (actually, exactly 5.5x; see proof below) more HH points than one earns starpoints FOR THE SAME SPEND.

In the real world, Hilton points are worth 0.4 cent each as HILTON CURRENCY but they are worth:

0.4×3 = 1.2 cents as Hyatt GP points (vs. the bloggers’ estimate of 1.4 cents)

0.4×6 = 2.4 cents as SPG points (vs. 2.2 cents by bloggers)

0.4×1.5 = 0.6 as IHG points (vs. 0.7 cent by bloggers)

because one earns 3 times, 6 times or 1.5 times more as HHonors point a clip than one earns Hyatt GP, SPG starpoints or IHG points, respectively.

In other words, the various hotel loyalty points are worth exactly the same (considering the uncertainty in valuing them), when they are adjusted for the relative abilities to earn them.

One way to understand this is to consider the relative abilities to earn starpoints on the SPG AMEX and HHonors points on the HH AMEX Surpass.

SPG AMEX earns:

2 points/$ for on-property purchases (i.e., for stays at SPG properties)

1 point/$ on everything else.

Mean: (2+1)/2 = 1.5 points/$

HH AMEX Surpass earns:

12 points/$ for on-property spend

6 points/$ for restaurant, gas, surpermarket purchases

3 points/$ on everything else.

To match SPG AMEX’s 2 categories, let’s take the mean of the latter two HH categories: (6 + 3)/2 = 4.5 points/$ for everything else.

Overall mean for HH AMEX Surpass: (12 + 4.5)/2 = 8.25 points/$

So that (Mean HH/$)/(Mean SPG/$) = 8.25/1.5 = 5.5

It means that more exactly, I earn 5.5x more HHonors than I do starpoints for the same spend.

Therefore, if I go to a bar, purchase two identical drinks @ $1 each and pay for one with the SPG AMEX and for the other with the HH AMEX Surpass, I will earn 1 starpoint and 5.5 HHonors points.

If each starpoint is worth 2.2 cents, then each HHonors points is worth 0.4 * 5.5 = 2.2 cents IN TERMS OF SPG points.

See? The values are IDENTICAL when the math is done rigorously and the points adjusted for the relative ability to earn them (i.e. they are put on the same scale so they are comparable). Starpoints, GP points, HH points, IHG points, etc, are worth exactly the same and that is not by accident. Similar items usually cost about the same in real currency. It makes sense that they would cost about same in loyalty currency.

So, it is fine to use the valuations within one currency. That has some meaning. On the other hand, valuations are not meaningful when used to compare different currencies, unless adjusted for the relative abilities to earn the points being compared.

The superfluous valuations aside, I agree that this is the best deal that Hilton has offered on the sale of their points.

@DCS — If I buy a paper airplane at a toy store, I’d wonder whether I should use an Amex Surpass or a Barclay Arrival Plus. I have both in my wallet. The Barclay Arrival Plus earns 2.22 cents per dollar. The Surpass would earn 3 Hilton points.

It would be VERY hard to find a redemption in which the Hilton points go as far as money does at that valuation (.74 cents each). Thus, the Amex Surpass stays in a drawer.

Now at 6x/$ categories, that’s a different story…

Manufacturing spending at the supermarket with the Hilton card costs less than 0.25 cents per point. $6.95/3000 points at 6X

“You can get a $900 per night ocean villa with private pool for $380 per night worth of points.”

The issue is that CKS is worth nowhere near $900/nt (similar to how Conrad Maldives is worth nowhere near the $1500+/nt they charge). At that price point, you have your pick of some world class resorts, The $380/nt is much more in line with what they should be charging… It’s a nice place, but it’s not Amanpuri nice.

$800 for 160k points. As Joe points out, this is mostly a sucker play for those who use points at the high value properties that Gary and his buddies like to visit. 160k doesn’t even get you 2 nights at the properties that consistently come up @95k/nt (e.g Rome). And are there really any leisure travelers who use points to stay at the crappy 5k properties? None that I know.

Note the Conrad KS is available for $593/nt prepaid, so not really $900 everyday. The Hilton Wakiloa Village (which is more accessible to most) is $229/nt in June or 51k+ points or .004. Much better to spend the $800 on lodging, preferably at a better chain that provides better elite benefits…

We stayed 5 nights at the Conrad KS in March for 76K per night. (5th night free). As a Diamond they upgraded us to a 2 BDRM / 2 story pool villa. It was the nicest room we’ve ever stayed on points. I can’t argue with the value of that stay. It was pretty easy to accumulate 380K Hilton points thru a combo of sign up bonus and MS. But, to buy Hilton points speculatively, no thanks.

@stvr sez: “It would be VERY hard to find a redemption in which the Hilton points go as far as money does at that valuation (.74 cents each). Thus, the Amex Surpass stays in a drawer.”

You should study my long comment above until you understand it because what you just stated shows that you did not get it. The purported cataclysmic “devaluation” of HHonors points is a myth because HH awards were and remain as competitive-priced as any in the business.

Take this example:

Awards for very top category Hyatt hotels cost 30K points/night

Awards for very top category Hilton hotels cost 95K points/night

The basic point earning ability for a Hyatt GP Diamond is: 6.5 points/$

The basic point earning ability for a Hilton HH Diamond is: 20 points/$

Relative earnings: 20/6.5 = 3.1 [this ratio stays about the regardless of elite level or source of points]

The meaning of that ratio is that a HH Diamond earns 3.1 times more HH points a clip than a GP Diamond earns GP points. Thus, adjusting the award rate of the top cat HH hotels for the relative earning abilities, we get:

95K/3.1 = 30.6K points.

which is the same the 30K GP points that one would pay for an awards at top cat Hyatt hotels. Because 95K HH ~= 30K GP, award rates for top category Hilton and Hyatt properties COST EXACTLY THE SAME, when adjusted for the relative abilities to earn their respective points. Q.E.D.

You should, therefore, be consistent and also say: “It would be VERY hard to find a redemption in which the HYATT points go as far as money does at that valuation (.74 cents each). Thus, the CHASE HYATT stays in a drawer.”

BTW, when the equivalence among the loyalty points does not hold is when you know that awards are either extremely expensive or extremely cheap. It is why SPG is the costliest program in the business for top-tier hotels… 😉

When we talk about valuation of loyalty currency, aren’t we talking about the value of such currency can realize (by way of redemption) but not how difficult to earn such currency.

I am not buying at .5 cents per point. I value at .4 or maybe even .3 A quick look at some dates and locations of where I am planning on travelling and the rates were about $200 paid or 60,000 points. Points would not make sense. So I looked at other locations and was generally coming up with rates that were in that same ball park. So I might argue that your .5 cent might be even on the high side, especially in cases where you are not staying 5 nights.

@DCS:

You are valuing HHonors at the same valuation as all others. You are missing one key factor though. Redemption. Hilton blacks out entire hotels for a year at a time. Making my 160K points worth zero. If I can’t redeem, then what is the use of the points? I’ve seen blackouts at other properties, but never for 3,6,8 months stretch at a time. I believe this is another reason bloggers devalue the points more. Sure, you can earn them, rack them up. But if you can’t redeem them then what is the point? Why waste my dollars on a surpass card with an annual fee when I get nothing from it.

We must NOT dismiss the taxes that are waived when paying with 100% points. In a place like Hawaii you will be avoiding hundreds of dollars of additional costs by booking with points. So for example, if you booked a 6 night $404/night in Waikoloa Hawaii you would avoid $325 of sales taxes.

In a place like Tahiti, where it appears its completely booked or blacked out a year in advance, you need to pick up a telephone to book it with points.

@Meathead: “Hilton blacks out entire hotels for a year at a time.”

I’ve been with HHonors for years, mostly as a Diamond, and it is the first time that I hear that claim. Any solid proof or is this yet another hearsay that passes for dogma in the travel blogosphere?

I have never failed to find standard awards for redeeming at any Hilton property. Is that a just coincidence or could it have anything to do with the fact that I plan early and do not wait until the last minute to book my award stays, to avoid finding all standard awards gone and be left only with “premium” awards, which are usually unaffordable?

Why do you almost always use Maldives, Koh Samui, or Bora Bora properties as examples? Why not New York, London, Paris, or Rome? The above mentioned properties might be inspirational to some, they are boring to many others!

@DCS:

I’m not trying to argue or shill out “hearsay”, I’m giving you my personal experience. I was trying to make a legitimate point. I left Hilton before the devaluation simply because of frustration over trying to book nights.

1- these weren’t in exotics like Tahiti. Most were North American- the US and/or Canada.

2- these weren’t last minute either. I said they were booked out for a year.

I went in, tried to book my 5 or 6 night stay and kept reloading new date ranges. And every week stated “no availability”.

After about a half dozen attempts I started moving toward other programs. HHonors just wasn’t worth the hassle. I still have one HHonors card I use for the odd gallon of gas. and I will use my points for a night here or there. but as far as an aspirational program and building my point balance up beyond 100K, I just find it to be an exercise in frustration at the time of redemption.

Each program has its merits and its drawbacks (free night certs at Marriott anyone). I was attempting to highlight a drawback I’ve found at Hilton and why someone may value the points less than others.

@meathead — This sounds to me like an exaggeration, whereby someone takes a rare occurrence and tries to turn it into a pattern. The other trouble I have with your claim is that it happened in North America, where there are few truly “aspirational” properties worth claiming to be sold out all year around, and where there seems to be a Hilton on every block, so that if one property is unavailable one would just try another, then another, then another in the same city and neighborhood!

My experience completely contradicts yours. I do not believe that what you claim to be a “problem” is real, especially since you also seem to believe that the purported cataclysmic “devaluation” of HHonors points, which I just showed above does not exist, is real 😉

@Kalboz because I write what is interesting to me! 🙂

@Gary — Actually, I like it that you write about aspirational properties in “exotic” places because I more likely to do Bora Bora than London 😉

I need to spend $3,000 to secure a zig up bonus on a new Hilton Amex card. Wouldn’t buying Hilton points be a good way to secure the bonus?